What is LDI?

LDI is a common

acronym for Liability Driven Investment. Globally, corporate-sponsored, defined

benefit pension funds have embraced an LDI-framework to setting investment

strategy. Adopting an LDI strategy means that investment risk is no longer

defined predominantly in relation to the standard deviation of investment

returns. Rather, the concept of investment risk is extended to include all risk

which could impact the volatility of asset values relative to liability values.

In summary, LDI is a framework for setting investment strategy which has, as

its end goal, the reduction of volatility in asset values relative to liability

values.

Importantly LDI

is not limited to consideration of a single asset class, for example, bonds;

the LDI framework can (and should) be applied across all asset classes in order

to arrive at a holistic view of the volatility of all asset classes relative to

the liabilities. The table and diagram below sets out the types of risk that

will typically be considered when adopting an LDI approach.

Table 1: Factors influencing asset and liability

values

|

Factors influencing

volatility of asset values

|

Factors influencing volatility of liability values

|

|

Systematic (or market) risk

(e.g. equity market risk for equities or property market risk for property

investments

|

Interest rate risk

|

|

Credit risk

|

Inflation risk

|

|

Liquidity risk

|

Longevity risk

|

|

Active manager risk

|

Model risk

|

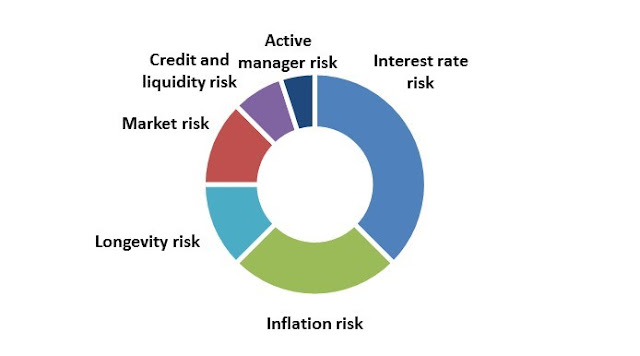

Chart 1: Risk attribution with liabilities

Table 2: Brief description of factors influencing

asset and liability values

What have been the catalysts for

this focus on LDI?

Globally we can

point to two main catalysts for extending the definition of risk and hence for

the focus on LDI:

1.

Accounting regulations:

During the noughties changes in global accounting regulations resulted

in sponsor balance sheets becoming more responsive to recognising changes in pension

fund surpluses or deficits (defined as the difference between assets and

liabilities) and the latter moving to the use of mark-to-market approaches to

value both the assets and liabilities. Together these developments introduced

greater volatility in a sponsor’s balance sheet as a result of changes in the

pension fund’s surplus or deficit. CFO’s became increasingly concerned that

such volatility could materially (and adversely) impact the company’s financial

results for reasons that were unrelated to the company’s core business. This

was especially true for companies that had pension fund’s whose liabilities

were large relative to the company’s market capitalisation – a small, adverse

change in a large pension fund liability could swamp any positive performance

in the company’s core business.

The poster-children for the adverse impact that these developments

could have on a company were two well-known British companies, British Airways

and British Telecom. Table 3 below illustrates that the relative size of the

pension liabilities and market capitalisations at these two companies are such

that a small change in their liability values would have a large impact on

their market capitalisation.

Table 3: Pension

liabilities and deficits (Source: Accounting for Pensions 2010; LCP)

|

Company

|

Pension liabilities

|

Pension deficit

|

Market capitalisation

|

Liabilities / Market cap

|

Deficit / Market cap

|

|

British

Airways

|

£12.8bn

|

£0.6bn

|

£1.6bn

|

791%

|

37%

|

|

British

Telecom

|

£33.2bn

|

£4bn

|

£6bn

|

551%

|

66%

|

2.

Funding regulations:

Following

a number of high profile pension fund failures; the result of failure of the

sponsor coupled with a poorly funded pension fund, many pensioners were left stranded.

Regulators moved to tighten funding regimes for pension funds by emphasising

the need for a clear plan to deal with any pension fund deficit and within an

acceptable timeframe. Increasingly, the

emergence of deficits in pension funds were at the top of the agenda for company

financial managers who could no longer kick the can further down the road.

Deficits were having a direct and adverse impact on their cashflows by

requiring higher contributions to be injected into the pension fund. All of

this was taking place in the midst of the worst financial crisis in history.

In the early

part of the noughties these themes played out across Continental Europe and the

UK and then, in the latter part of that decade, these changes played out in the

US and closer to home in South Africa. Today, corporate pension plans in the US

and South Africa are leading the charge to the adoption of LDI strategies with

many sponsors in these countries also moving to the “so-called” end-game more

swiftly than their UK counterparts, i.e. the transfer of these pension

liabilities to an insurance company and, in so doing, entirely eliminating the

pension liability from their company balance sheets. But that is a subject for

a future article.

LDI in Africa

Defined benefit

pension schemes are not as prevalent in Africa as they are in the UK and the

US. In South Africa, the continent’s largest pension fund market, defined

benefit pension schemes were closed to new entrants in the nineties and their

demise was hastened by offering members incentives to transfer out to newly

established, defined contribution arrangements. That said, a few large legacy

defined benefit pension funds are still in existence and many of these funds

have moved towards adopting a LDI strategy, especially for assets backing their

pensioner liabilities. The adoption of similar strategies by large pension

funds in the rest of the continent is not without challenges due to less

developed capital markets but, as discussed, LDI is not about investing in

specific assets but rather about the adoption of a framework for the holistic

consideration of managing funding level volatility. Adopting such a framework

is of paramount importance as a first step towards improved risk management and

governance.

Future developments

An LDI framework

is not limited in its application and can (and should) be extended to defined

contribution arrangements. The absence of a clearly defined or guaranteed

liability does not imply the absence of such a liability. In fact, members of

defined contribution pension funds are left with no different a challenge –

they too need to be sure that they are accumulating sufficient savings in their

pension funds on which to ensure a comfortable existence in old age. Arguably,

members of these defined contribution arrangements require even greater

financial assistance to define clear retirement objectives and goals. LDI can

be used to frame such goals by linking savings goals to incomes required in

retirement and in this way setting an appropriate long-term investment

strategy.

In summary, LDI

is a framework for managing investment risk. It has proved to be a useful tool

for setting investment strategy especially where there are dual objectives of

targeting a long-term savings goal whilst still focusing on the need to ensure

acceptable investment outcomes in the short term. There is an analogy to be drawn between a

limited-over cricket game and LDI. In both cases the long-term goal is achieved

by the successful achievement of a series of shorter-term goals which when

taken together yield the desired end result.